A few weeks ago I attended the Customer Experience Management for Banking and Financial Services conference, presenting on driving agility into your customer experience. There were some great presentations, it is great to see the banks taking customer experience seriously. From my notes, what follows are some of the presentations and ideas that resonated with me.

Anthony Thomson, Metrobank

Anthony Thomson, chairman of Metro Bank was inspiring. Everything they do is from the customer perspective.

For everything Metro Bank do, they ask ‘why are we doing this?’ Is it going to make our lives easier, or is it going to give our customers a better experience? The second trumps the first every time.

Metrobank see that they (like all banks) are essentially a money shop who sell the same products as their competitors. The only real differentiator is experience and service. With the Vickers Report recommending “the early introduction” of a system that makes it easier to move accounts and that is “free of risk and cost to customers”, this is going to become increasingly more important.

Retail is detail is the old adage. Think about something as small as the pen on the counter. Chaining it down may suggest security, until you see a chain with no pen attached. Anthony questioned what is the cost of a pen? What is the value of having your branded pen in your customers’ kitchen? Talking of branding he showed a picture of a Metrobank van. Banks use vans all the time to transport the pens and stationary to the branches, but they are never branded. Is this security trumping marketing? A lack of joined up thinking? He commented on the press comments on Metrobank attitude towards dogs. Focussing upon the dog misses the point. Customers love their dogs, why shouldn’t they be allowed in the stores and be positively welcomed! By saying “no dogs” are you saying we care more about our carpets than our customers?

Another detail thing – how often have you waited outside a bank to open in the morning, or be hassled out because it’s the end of the day and is now closed. Metrobank have flexibility, they’ll open a little earlier if people are waiting outside and stay open till the last customer leaves.

A theme through Anthony’s presentation was of empowerment. Empowering staff, removing pedantic rules that get in the way of delivering a compelling customer experience. He told a story of how a customer had to wait longer for assistance than expected and incurred an £8 parking ticket. A member of staff wanted to refund the customer and suggested giving them £4. To which Anthony commented “and only half piss them off?”

Empowerment starts with recruiting good people. Only a fraction of the people who apply get to work for Metrobank. They understand that skills can be trained so they recruit for attitude. If someone whose job is to interact with customers on a daily basis doesn’t smile, they don’t get the job. When it comes to targets, they ‘measure what matters’. They incentivise on service not sales because with good service comes sales.

Rob Hawthorn, Barclays

Empowerment was a theme that ran through the presentation that Rob Hawthorne from Barclays gave. He’s taken a leaf out of the hospitality industry and borrowed from Ritz Carlton with their Credo Card, a single sided card that reminds their staff of the levels of service they should provide. Barclays corporate staff are empowered to fix the problem. Like Metrobank they strive for no stupid rules and put the customer first. For example a customer pays in £230.60 and only £230.20 is credited to the account. They now refund then investigate. By introducing this policy change they say a 65% reduction in customer complaints.

Everyday, in every Ritz Carlton hotel they have The Line-up. This is a fifteen minute meeting to review guest experiences, address issues and identify how they can improve service. It is an opportunity to tell stories, both top down (what’s going on in the company overall) and bottom up (what can we learn from individuals and their interactions with customers). Barclays corporate do this across the organisation. From the top down they have one version of the truth; what is happening in Barclays world, what is important and what are customers saying today?”

The fifteen minute meeting is a familiar concept within agile, known as the standup it’s a brief meeting where the team review what they did yesterday, what they are doing today and any issues or blockers they are facing.

“How often do you see your complaints data?” Asked Rob. What use is seeing it once a month? You should be seeing it every day. Better still (and this is something that I alluded to as well), walk in the shoes of your customer. Get out into the branches, into the call centre and see what is going on for yourself.

Richard Brimble, Veolia Water

Not FS, but Richard gave a view on customer experience from a different viewpoint. He gave an engaging presentation that started by asking if you are a blue tit or a robin. Blank states from the audience, so he elaborated. After the first world war milk companies started sealing milk bottles with foil tops. Until then the bottles had open tops and both robins and blue tits would drink the cream from the top. With the foil tops the birds had to learn to peck through them. By the 1950s the entire blue tit population had learned this. Robins never did. Robins are territorial and solitary creatures, whilst blue tits are social. They may be scruffy compared to the elegance of the robin, but they are innate communicators. They share their learnings and copy each others successes. As an organisation are you a robin or a blue tit?!

Sean Gilchrist, Barclays

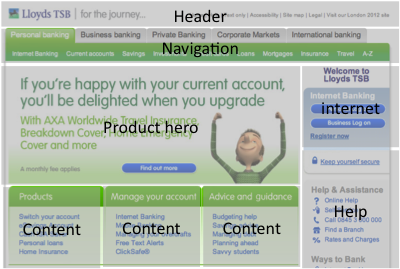

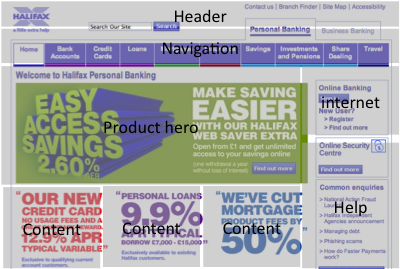

Is Barclays going all Lean Startup? Sean Gilchrist from Barclays told a story of their lean customer development approach to developing their mobile bank Barclays.mobi. The journey started in data; a significant minority of customers were accessing internet banking using mobile devices. A clunky experience at best. Rather than going the Big IT route they went lean and did some customer discovery. “What’s important to you?” they asked customers. “Checking balance” they were told. “How about paying bills on your mobile?” they asked, “No, we just want to check balances” was the response. “How about a branch location finder?” to be told “No, we just want to check balances”. In eight weeks and on a shoestring they built and launched their minimum viable product, Barclays.mobi. The product was instantly successful and gave the team leverage to continue development.

Sean told another story about the perils of just pushing something into production without thinking about how people behave on-line. To access account information on on-line banking the customer has to use a security device that displays digits that are then entered into the application. The digits were displayed in two blocks of four:

1234 5678

A decision was taken to replace the single field on the application where this number was entered into two fields that better represented the way the number was presented on the screen, i.e.

|1234| |5678|

The week they made this change they received over thirty thousand complaints about this change. When I’ve recounted this story to Barclays customers they can remember when this happened and what a pain it was. People who don’t touch type look at their keyboard, not the screen. They entered the number as one continuum, not in two blocks. Tabbing between fields is an ‘advanced’ technique. Suddenly the customer was unable to enter the number without having to use their mouse to move to the next field. A change that was suppose to reduce errors ended up causing more. The issue was fixed by have an auto-tab between the fields, but not before customer complaints. Usability testing (oe even having an experienced usability expert on the team) before going live would have picked this issue up.

Trent Fulcher, RBS

Finally Trent Fulcher from RBS presented on the customer experience and innovation work he has been doing at RBS. A key takeaway from his presentation was that at RBS they demonstrated a positive correlation between advocacy and revenue per customer. Not only are advocates more profitable, they also bring new customers to brand. RBS accepted that they will always have detractors to the brand and are happy to take a calculated decision not to focus upon changing their perceptions, rather focus on ‘passives’ and move them to advocates. He demonstrated how RBS modelled their customer journeys, understanding what customers value and expect from every touch point. What they discovered is that for some touchpoints they were overreaching on these expectations, enabling them to understand if they were focussing effort on the parts of the journey that Make A Difference.